Multi-family office is:

THE PERSONAL ASSISTANT (PA)

Sometimes the family office can essentially be a PA service. The family needs someone to help them with their daily needs (which can be anything from drafting letters to arranging flights and accommodations to walking the dog) and the PA is at their beck and call. In this insistence, the family office is a convenience.

THE CONCIERGE / LIFESTYLE MANAGER

When these needs become more complex the emphasis shifts and the family needs a more proactive service than a PA. A concierge or lifestyle manager can monitor and deal with more complex issues such as household staff management, placing insurance across the family assets, liaising with charities that the family supports.

THE FINANCIAL OFFICE

In addition to managing lifestyle needs, often the family needs someone who can manage their day-to-day financial affairs; paying bills, placing fixed deposits, paying household staff and managing day-to-day cash needs

THE FAMILY BUSINESS OFFICE

The main purpose of the family office is to act as the eyes and ears for the family in their directly owned businesses. In this sense, the disparate businesses that the family might have invested in need someone to act as a head office, to ensure that the businesses are not unnecessarily in competition with each other, and to ensure good corporate governance.

THE ADMINISTRATIVE FAMILY OFFICE

Sometimes a family will have many complex structures in place to manage their financial and personal affairs. The administration burden of managing those structures often creates the need to have a full-time, dedicated team whose main, purpose is to ensure that the companies and trusts within the structure are being managed effectively

How it works?

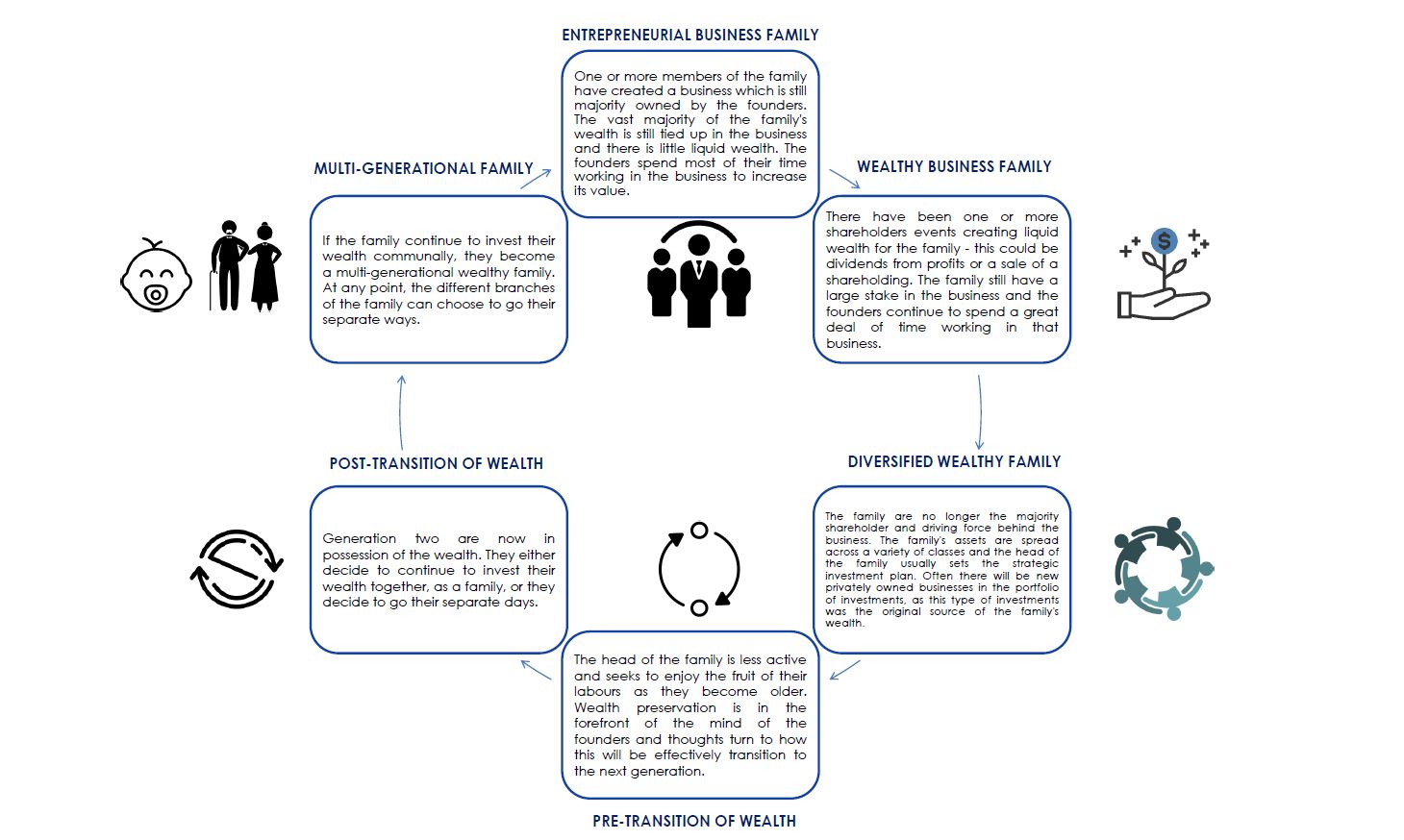

THE ENTREPRENEURIAL BUSINESS FAMILY

Cash-poor, time-poor, single business asset family

Often, the Finance Director of the family business or the family’s lawyer doing some of the family office type services.

PRE-TRANSITION OF WEALTH

Cash-rich family with a settled lifestyle, time-rich, founders enjoying the fruit of their labors

Perhaps a little more passive than above – less day-to-day involvement, and more desire to use external managers, in order to preserve capital and seek returns.

THE WEALTHY BUSINESS FAMILY

The cash-flow positive, time-poor, high concentration of assets still in the family business

Bring order to the chaos – think about the overall family wealth from an overview and plan for the future. Look at de-risking overweight positions or hedging

POST-TRANSITION OF WEALTH

The second-generation – stay together? Conflict and different needs / wants

The family office would appear to have a lasting place if the family wants to stay together

PRE-TRANSITION OF WEALTH

Cash-rich family with a settled lifestyle, time-rich, founders enjoying the fruit of their labors

Perhaps a little more-passive than above – less day-to-day involvement and more desire to use external managers to preserve capital and seek returns

MULTI-GENERATIONAL FAMILY

Multi-generational – either stay together because of common interests or because of remaining interests in the family business.

Is the family office now a business in its own right that happens to be privately owned by a wealthy family?

10 reasons for managing family affairs via a family office

1

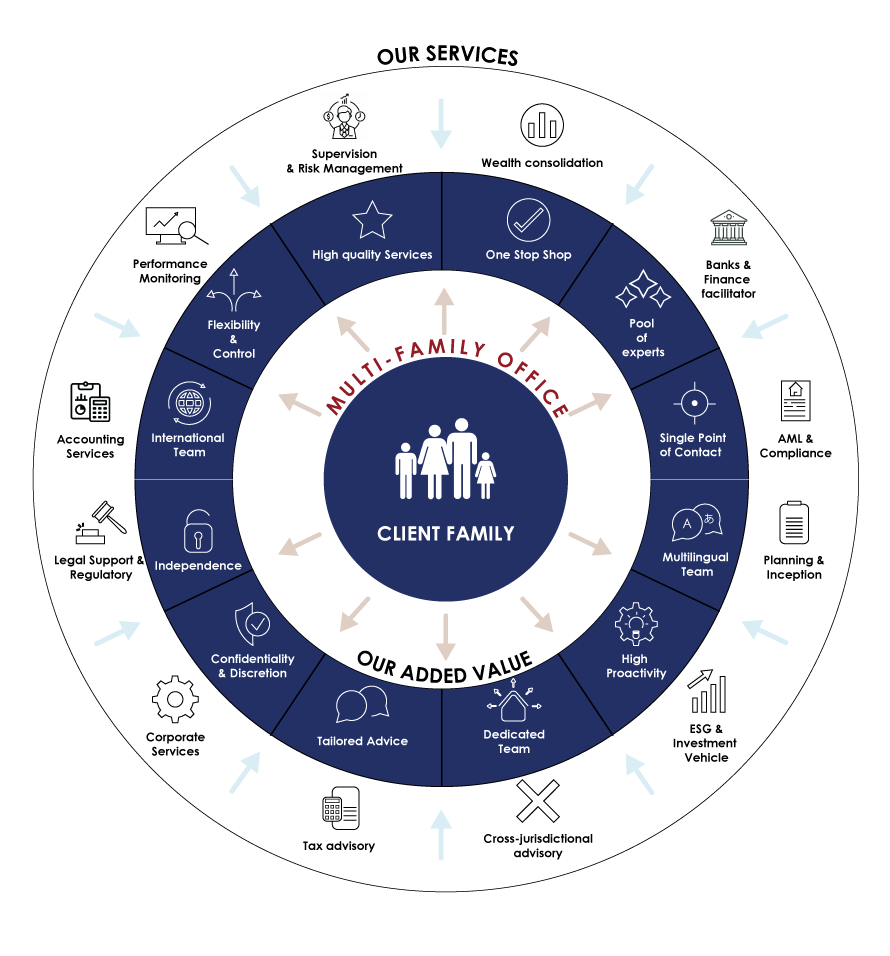

CONFIDENTIALITY & DISCRETION

Hight-net-worth individuals are highly sensitive to maintaining confidentiality for a variety of legitimate reasons. Setting up their own SFO (Single Family Office) or MFO (Multi-Family Office) gives them the confidence and peace of mind that their information and data are being kept private.

2

TRUST

Often HNWIs will employ professional advisers who they have worked for some time and who they have grown to trust with their affairs.

3

INDEPENDENCE

By employing their own staff or engaging with an independently owned MFO, HNWIs (High net worth individuals) can ensure that their family office’s interests are closely aligned to their own with no conflicts or interest.

4

TIME-SAVING

Most wealthy families quickly realize that with great wealth comes the burden of managing that wealth. In this sense, time is truly precious and a family office may be used to manage personal homes, luxury assets, take care of travel arrangements, and deal with what can be sensitive tasks.

5

COST SAVING

Not only can the family office therefore provide a more holistic solution, it can also be more cost-effective than utilising a range of external advisers

6

ACCOUNTABILITY

HNWIs want the staff reporting to them to be directly accountable for their actions. Consistency of personnel and a “long life” employer-employee relationship means that family office staff understand the long-term effect of their role and actions.

7

DEDICATED STAFF

Staff in an SFO are entirely dedicated to one client family and can therefore easily prioritize their workloads. Increasingly, we are seeing MFOs employing staff who are dedicated to a single client.

8

FLEXIBILITY

As the staff are reporting directly to the HNWI in an SFO or based on a bespoke service agreement in an MFO, their roles and responsibilities can be as flexible and varied as the HNWI requires

9

CONTROL

HNWIs can directly instruct staff within the family office. This means that the family office recruits and mentors staff who are highly skilled and focussed on their client’s family needs.

10

TAILORED SERVICE BASED

The staff of the family office can know the whole picture – the tax and legal structure, the likes, and dislikes of the HNWI and their family, together with a very deep, personal, and historic knowledge of the family’s affairs which means that the service offered can be extremely personalized.

Why Esperia ?

- Offers high-end fund administration and corporate services to business vehicles with personal touch of a small firm;

- Clients involved in various businesses such as Private Equity, Real Estate, Intellectual Property, wealth management, e-commerce, etc

- Provides reliable and responsive tailor-made solutions demonstrating an attention to detail;

- Over 13 years of existence;

- Is independent;

- Worldwide clients range varying from entrepreneurs, family offices, international groups, institutional etc.